What is new from West One?

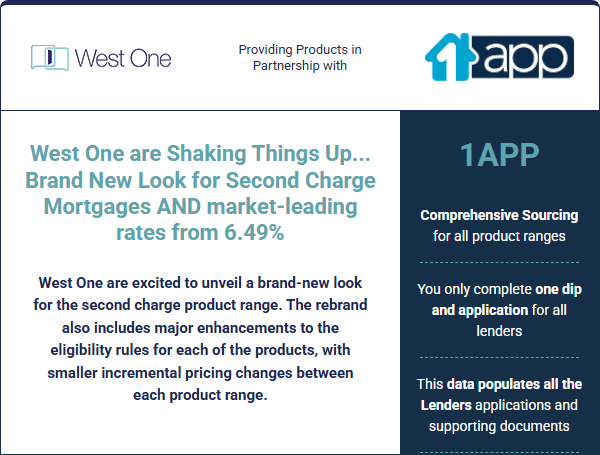

- New plans, New Credit Tiers, Lower Pricing!

- Introducing a brand-new look with the unveiling of new plans, Platinum, Prime Plus, Prime, and Near Prime Credit Tiers

- Changes to the credit eligibility rules means more borrowers will now qualify for lower-priced products than ever before, including missed payments on unsecured credit and mortgage accounts, as well as borrowers who have historic or more recent CCJ’s and Defaults

- They have also reduced the interest rate loadings between each plan to create more competitive pricing throughout the range

- Widening of the Credit Criteria on

Unsecured Arrears- New Platinum Product offering their lowest pricing with a maximum status of 2 in 12 for unsecured arrears

- Unsecured Arrears with max status of 3 in 12 now available from 6.79%

- CCJ’s/Defaults

- Removal of £1250 limit for CCJ’s and Defaults unsatisfied in the last 12 months

- Can consider up to 2 unsatisfied CCJ’s/Defaults in the last 12 months with rates starting from 7.39%

- Secured Arrears

- Now consider up to 2 secured missed payments in the last 12 months (0 in 3) on our Near Prime Plan with rates starting from 7.39%

- Now consider up to 2 secured missed payments in the last 12 months (0 in 3) on our Near Prime Plan with rates starting from 7.39%

- Introducing Market-Leading Pricing Plus Standardised Pricing Approach to Fixed Rate Products

- 2, 3, and 5-year fixed rates now available from 6.49%

- Reductions of up to 1.30% across the product range

- No differential in pricing for each fixed rate term to enable advisers to tailor advice to offer the most appropriate fixed rate term for their client

- Major Enhancements to Interest Only Criteria

- Interest-only options are now available as part of the standard product range up to 65% LTV for Platinum and Prime Plus borrowers

- New Lower Rates starting from 6.49% and lower lender fees starting from £995 (previously £1995)

- Minimum Income Reduced to £15,000

- Minimum Loan size £10,000

- Maximum age at the end of the term now increases to age 75

- Maximum LTI cap of 6.5 times

- Requirement for Minimum Property Value of £200,000 has been removed

- If downsizing, the minimum equity required is £150,000

- AVM Criteria Enhancements

- AVM’s up to 80% LTV now available for Platinum and Prime Plus Borrowers

- AVM’s up to 80% LTV now available for Platinum and Prime Plus Borrowers

- Reduced Stress Testing and Significant Rate Reductions for Buy-To-Let Second Charges

- They have reduced the stress test to allow more borrowers to access second charge Buy-to-Let mortgage finance

- Significant Rates Reductions of up to 166bps with pricing now starting from 6.99%

- Improved credit criteria with highest maximum status for unsecured arrears now 2 in 12 for BTL Plus customers

- Unsatisfied CCJ’s and Defaults over 12 months old now considered for BTL Standard customers

- Max LTV reduced to 70% LTV

Can we support you and your clientswith your specialist cases?

To discuss a case call 0330 127 0000

or email newbusiness@allmoneymatters.co.uk

Refer your case to us call 0330 127 0001

or email info@allmoneymatters.co.uk