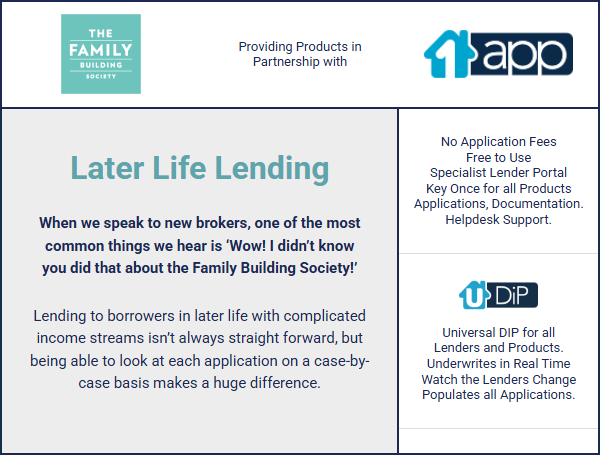

Later Life Lending

When we speak to new brokers, one of the most common things we hear is ‘Wow!

I didn’t know you did that about the Family Building Society!’

Lending to borrowers in later life with complicated income streams isn’t always straight forward, but being able to look at each application on a case-by-case basis makes a huge difference.

They take great pride in how they do things, and it works.

How can they help?

- They take into account earned income up to the age of 70, or even 75 if the client is in a non-manual role

- Other income can be considered on a case-by-case basis, such as:

- Up to 90% of investments or pension pots (divided by the mortgage term)

- State and private pensions

- Rental income

- Stocks and shares ISAs

- Remuneration drawn by limited company directors (where the applicant is not actively running the day-to-day business operation)

- They lend in retirement with higher maximum ages than most lenders:

- Owner Occupier repayment mortgages, up to a maximum age of 95 at the end of term

- Owner Occupier Interest-Only and Buy to Let mortgages, up to a maximum age of 89 when the loan commences

- They have a common-sense approach to lending and use human beings, not robots, to underwrite each case. This means we can tailor our solutions to each of your clients’ needs

- Use 1APP and the AMM support team to find out if they can help you and your clients

Case study: Mr and Mrs Smith

Mr. and Mrs. Smith, aged 72 and 73, were mortgage-free and wanted to raise £220,000 from their £400,000 property – £80,000 for home improvements and £140,000 to gift to their children. Their joint income consisted of a £20,000 state pension, Mrs. Smith’s £4,000 private pension, and Mr. Smith’s £500,000 pension pot, which remained undrawn as they hadn’t needed it.

Most lenders the broker approached wouldn’t fully consider the pension pot because it hadn’t been drawn down, or would only count 3-5%, providing them with a theoretical income of £13,500 to £22,500 – far short of the income needed to secure £220,000 in equity.

However, our flexible lending criteria allowed us to consider 90% of Mr. Smith’s pension pot, equating to £450,000. We were able to offer the couple a 13-year mortgage term and divide the £450,000 over the term, giving them a usable income of £34,600 – enabling them to secure the full £220,000 they needed.

Taking this income into account, plus the desire to take it on an Interest-Only basis, we were able to offer them a five-year fixed rate mortgage.

To discuss a case call 0330 127 0000

or email newbusiness@allmoneymatters.co.uk

Refer your case to us call 0330 127 0001

or email info@allmoneymatters.co.uk