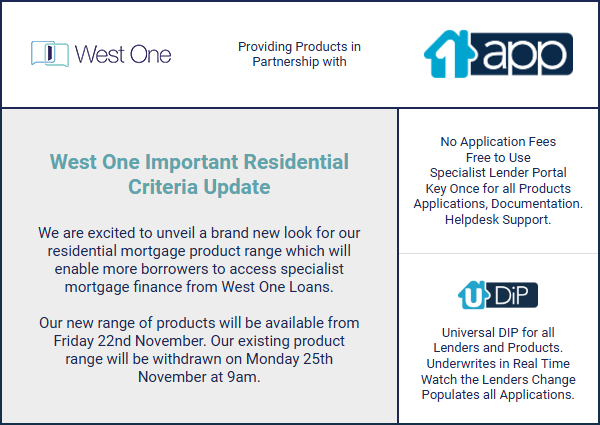

We are excited to unveil a brand new look for our residential mortgage product range which will enable more borrowers to access specialist mortgage finance from West One Loans.

Our new range of products will be available from Friday 22nd November. Our existing product range will be withdrawn on Monday 25th November at 9am.

Key Overview Of The Changes

- Introducing two brand new products, Premier and Platinum to replace our current Higher LTV Products

- Improved eligibility criteria across the range including many major criteria enhancements

- Simplified approach to lending making it easier to navigate our product range which also includes no credit scoring

- Up to 30bps reductions for 2-year fixed rates now starting from 6.05%

- Introduction of a fixed lender fee of £1795 across the range with increased availability of our fee-assisted range offering zero lender fee products

Highlights of the range includes

- Self Employed borrowers with 1 year trading history are now accepted on our Prime Plus plans offering LTV’s up to 85%

- Increased LTV’s up to 80% for our Prime product

- Improved criteria for borrowers with historic or more recent credit issues

- Wider eligibility criteria for borrowers seeking affordable housing solutions through our Shared Ownership and Right To Buy Products

Can we help?

Full details of our criteria changes can be found via 1APP and the AMM support team.

To discuss a case call 0330 127 0000

or email newbusiness@allmoneymatters.co.uk

Refer your case to us call 0330 127 0001

or email info@allmoneymatters.co.uk